Featured

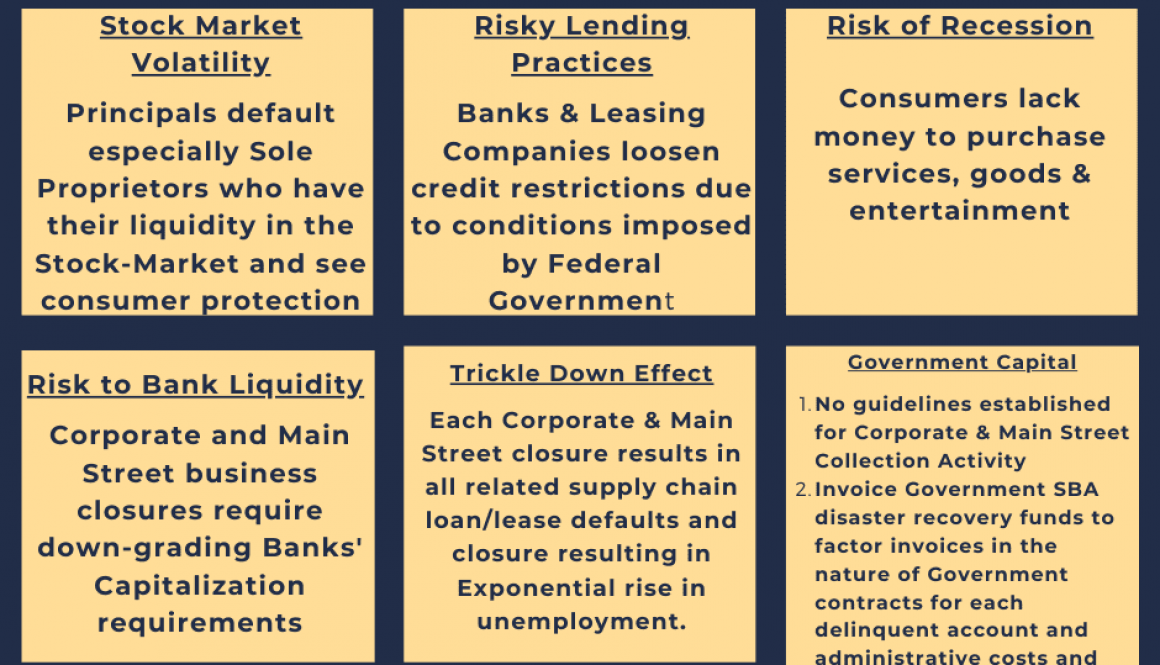

COVID-19 and the closure of corporate and main street businesses (either permanently or for the foreseeable future) triggers the necessity to have these businesses reaffirm their obligations in consideration of lender’s or lessor’s agreement to temporarily forebear “stay” from initiating or continuing Court actions. Forbearance agreements in other weakened economic times affecting main street have been helpful opportunities to shore-up the terms and provisions of the underlying lease agreements while at the same time preserving the obligations of the borrower or lessee. Contact Anthony Lamm whose experience in severe downtimes during the past 30 years helped maintain many accounts from requiring complete capital reserves. 267-217-1400 or Anthonylamm@lammlawpc.com

We Are Open!

tonylamm@lammpro.com, tonylamm@lammlawyer.com or (267) 217-1400

The Supreme Court could upend consumer financial protection as we know it

Latest developments in the Dodd Frank Act are contained in the excerpt from the NYT article attached. The Supreme Court is scheduled to hear arguments on the limitations of Dodd Frank and its governance by the FTC on March 3. As part of my regulatory compliance practice focused in part on Dodd Frank, please follow the appellate path of the “SEILA” case to the Supreme Court. For our interpretation and guidance please contact us! https://www.cnbc.com/2020/01/24/the-supreme-court-has-the-power-to-upend-consumer-financial-protection.html

SEC Office of Compliance Inspections and Examinations Publishes Observations on Cybersecurity. https://www.sec.gov/files/OCIE%20Cybersecurity%20and%20Resiliency%20Observations.pdf?utm_source=ALL+Contact+List&utm_campaign=75bdde1eb3-s-p-ocie-risk-alert_COPY_01&utm_medium=email&utm_term=0_d67232ec7d-75bdde1eb3-244798153&ct=t(s-p-ocie-risk-alert_COPY_01)